It’s Halvening: An Analysis of Bitcoin Miner Revenue

- Peter Ryan

- Jul 9, 2019

- 4 min read

Originally published on CoinSpice on July 9, 2019.

TL;DR: All versions of Bitcoin will experience a 50% issuance reduction within the next couple of years, a purposeful phenomenon known among enthusiasts as The Halvening. This ultimately reduces the immediate amount of revenue paid to miners and puts them in a sticky situation. A few solutions are in the works but require moving mountains and some molehills.

The Halvening and Miner Revenue

The halvening is when block rewards, given to miners for securing the blockchain and validating transactions, drop by 50%. Halvenings take place every 210,000 blocks or about every 4 years. Three major Bitcoin projects will experience a halvening in the next few years: Bitcoin Core (BTC), Bitcoin Cash (BCH), and Bitcoin SV (BSV).

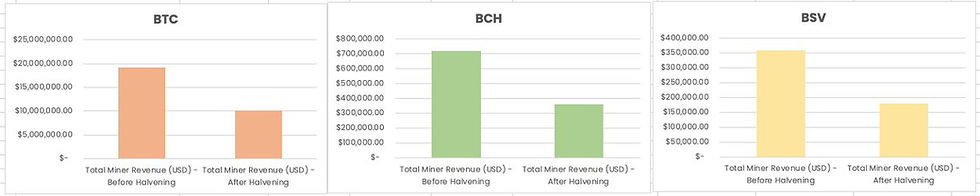

Bitcoin miners currently receive most of their revenue from those block rewards. The percentage of total revenue derived from block rewards makes up over 90% on each Bitcoin. The block reward dropping from 12.5 units to 6.25 will cause an approximate and immediate 45-50% drop in total revenue.

Assuming a constraint of constant fees, let’s explore two options for miners to make up the lost revenue: Transaction growth, which requires onboarding many new users or maintaining a highly engaged small population, and Price growth, which requires getting speculators to value the coin more.

Staggering Feats

To maintain current levels of miner revenue, each Bitcoin would need the following growth in transaction levels: BTC 2.9 million (753%+), BCH 36 million (71,900%+), and BSV 180 million (359,900%+). They would need to accomplish these staggering feats in such a short time frame that would make even Series D startups quiver.

On the other hand, growth in price seems much more attainable by comparison. The prices at which the halvening would be offset are BTC $19,000 (98%+), BCH $799 (100%+), and BSV $400 (100%+) — nearly a doubling of current prices appears necessary to compensate for the reward reduction.

Alternatively, little discussion is had around miners providing secondary services.

Miners are not just pawns of developers and users. They are some of the most astute and experienced players in the industry. Such expertise can be used to provide services tangential to their direct mining activities.

Data Auditing Services

For instance, they could provide blockchain data auditing services. If certain companies or individuals want better reviews of transaction flows to validate contracts and claims, miners can be utilized to facilitate this function. Such revenue could theoretically support the kinds of operations giving them that edge in the first place.

Other streams of revenue could be derived from custodianship, exchange services, and payment processing. There are even some streams indirectly related such as artificial intelligence or generalized computing hardware. From an economist’s perspective, miners have an incentive to compete in the market and outdo one another by being more entrepreneurial. If competing against other miners produces innovation in hardware, those miners should extract all value from it, and not just a sliver.

It seems highly unlikely that transactions will increase enough to offset halvenings, however. Price growth seems reasonably attainable, and secondary services could be a game-changer yet to fully bloom. Perhaps baseline levels of miner revenue can be maintained if these solutions are pursued in unison.

Exploit Additional Value

However, there are still a few, yet-to-be-fully actualized mitigants. Although we’ve held fees constant in this analysis, increasing them is a way to exploit additional value from the transaction side of the revenue equation. In fact, BTC’s roadmap implies this as a necessity.

By restricting blocksize, the number of transactions per block is obviously limited. Thus, once BTC starts processing over 450,000 transactions, fees will tend to rise into the double digits and perhaps triple. Increasing fees probably limits recruiting additional BTC users, and so it is to be seen if those fees do more harm than good.

BSV and BCH seek to push fees down through bigger blocks, so the BTC option is closed. BSV has also sought a roundabout way of not needing as many users. Developers have updated BSV to handle more data within the individual transactions. Since fees are paid on the basis of data size, this allows fewer transactions consisting of larger chunks of data to inflate miner revenue. Thus, miners can be compensated through arbitrary data snuck into a similar number of transactions through a relatively constant user population.

BCH will not increase fees nor pivot into data storage. The options open to it require very high levels of growth in transaction count or a moderate (for cryptocurrency) increase in price. The introduction of SLP tokens this year has brought some positivity to the former. BCH isn’t just going after the market for currency but all units of value which include stocks, bonds, and yes…even a certain rodent’s arcade token. This potentially allows it more markets to penetrate and capture.

Overall, it’s uncertain if current miner revenue benchmarks are viable in the future. If miners don’t get a raise, will they quit? If governments impose taxes and regulatory costs, will profitability be a thing of the past? If another bear market occurs, will everyone be washed out? If this current moment of relative stability is some indication of homeostasis, the most pragmatic approach happens to be the most speculative.

Comments